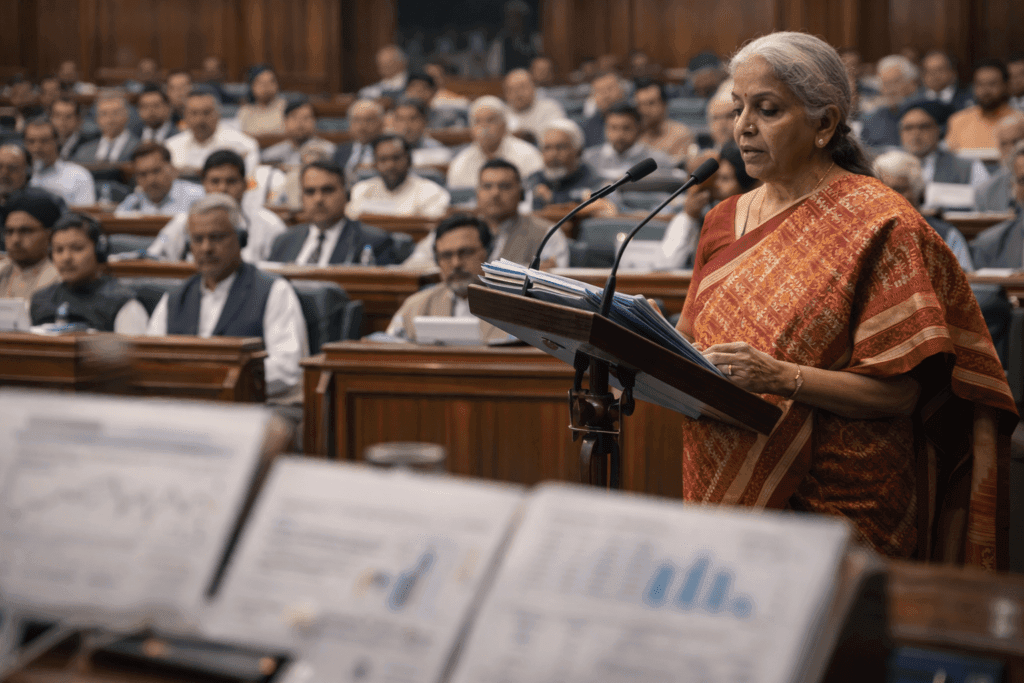

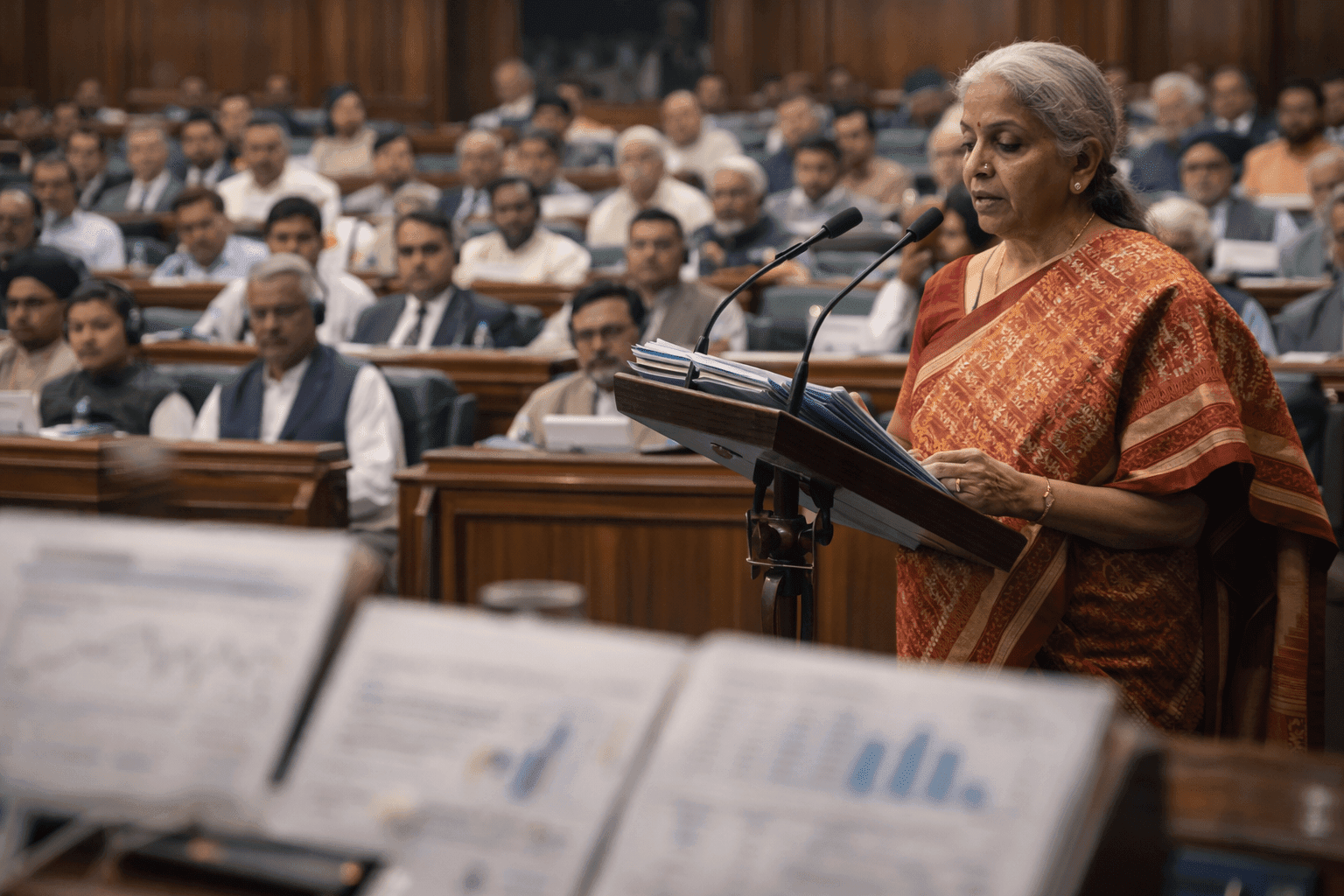

Union Budget 2025 Expectations: 9 Big Demands from Middle Class, Industry, and Investors

3 min read

Union Budget 2025 expectations are steadily rising as taxpayers, businesses, and financial markets look toward the government for relief, growth stimulus, and policy clarity amid slowing global growth and persistent inflationary pressures. The upcoming budget is expected to play a crucial role in shaping India’s economic trajectory for the next financial year.

https://samaacharbharat.com/category/finance

Middle Class Seeks Direct Tax Relief

One of the strongest Union Budget 2025 expectations is meaningful relief for the salaried middle class. With rising living costs, housing EMIs, and education expenses, taxpayers are hoping for:

- Higher income tax exemption limits

- Rationalisation of tax slabs

- Increased standard deduction

Experts believe such measures could boost disposable income and drive consumption-led growth.

Focus on Capital Expenditure Continues

Economists widely expect the government to maintain its aggressive capital expenditure push. Investments in roads, railways, ports, and urban infrastructure are seen as key drivers of job creation and long-term productivity gains. Continued capex spending is also expected to crowd in private investment.

Fiscal Discipline Under the Spotlight

Markets will closely watch how the government balances spending ambitions with fiscal prudence. Analysts expect a gradual reduction in the fiscal deficit while avoiding sharp spending cuts that could slow growth. Maintaining investor confidence remains a top priority.

Boost for Manufacturing and “Make in India”

Industry bodies are calling for further incentives to strengthen domestic manufacturing under the Make in India framework. Expectations include:

- Expanded Production Linked Incentive (PLI) schemes

- Support for MSMEs through easier credit access

- Reduced compliance burden for small manufacturers

These steps are seen as essential for boosting exports and reducing import dependence.

Banking, Credit, and Financial Sector Reforms

The financial sector is likely to feature prominently in Union Budget 2025 expectations. Reforms may focus on:

- Strengthening public sector banks

- Improving credit flow to MSMEs

- Encouraging digital lending with safeguards

Market participants are also watching cues from the Reserve Bank of India regarding coordination between fiscal and monetary policy.

Support for Startups and Innovation

Startups and the technology ecosystem are hoping for extended tax benefits, simplified compliance norms, and easier access to capital. With global funding tightening, domestic policy support could be critical for sustaining innovation and entrepreneurship.

Agriculture and Rural Economy Remain Key

Given the importance of rural demand, expectations are high for increased allocations to agriculture, irrigation, and allied activities. Measures aimed at improving farm incomes and rural infrastructure could provide stability to consumption patterns across the economy.

Green Economy and Energy Transition

Climate-linked spending is emerging as a major theme in Union Budget 2025 expectations. Policy watchers anticipate:

- Higher allocations for renewable energy

- Incentives for electric mobility

- Support for green hydrogen and sustainable infrastructure

Such moves align with India’s long-term climate commitments while opening new investment opportunities.

Market and Investor Sentiment

Equity markets are likely to react to signals on taxation, disinvestment, and policy continuity. Investors generally favor budgets that prioritize growth, maintain fiscal discipline, and avoid sudden regulatory surprises.

Policy experts also stress that Union Budget 2025 expectations include greater transparency in expenditure outcomes, time-bound implementation of announced schemes, and clearer medium-term fiscal guidance, helping businesses and investors plan capital allocation with higher confidence amid an uncertain global economic environment.

The Broader Economic Context

The upcoming budget will be presented against a backdrop of global uncertainty, geopolitical risks, and moderating growth in major economies. Domestically, strong infrastructure momentum and stable macro indicators provide a supportive base, but execution will remain key.

As Union Budget 2025 expectations continue to build, the government faces the challenge of balancing relief, reform, and responsibility. The final blueprint will not only define fiscal priorities but also influence confidence among households, businesses, and global investors in the year ahead.