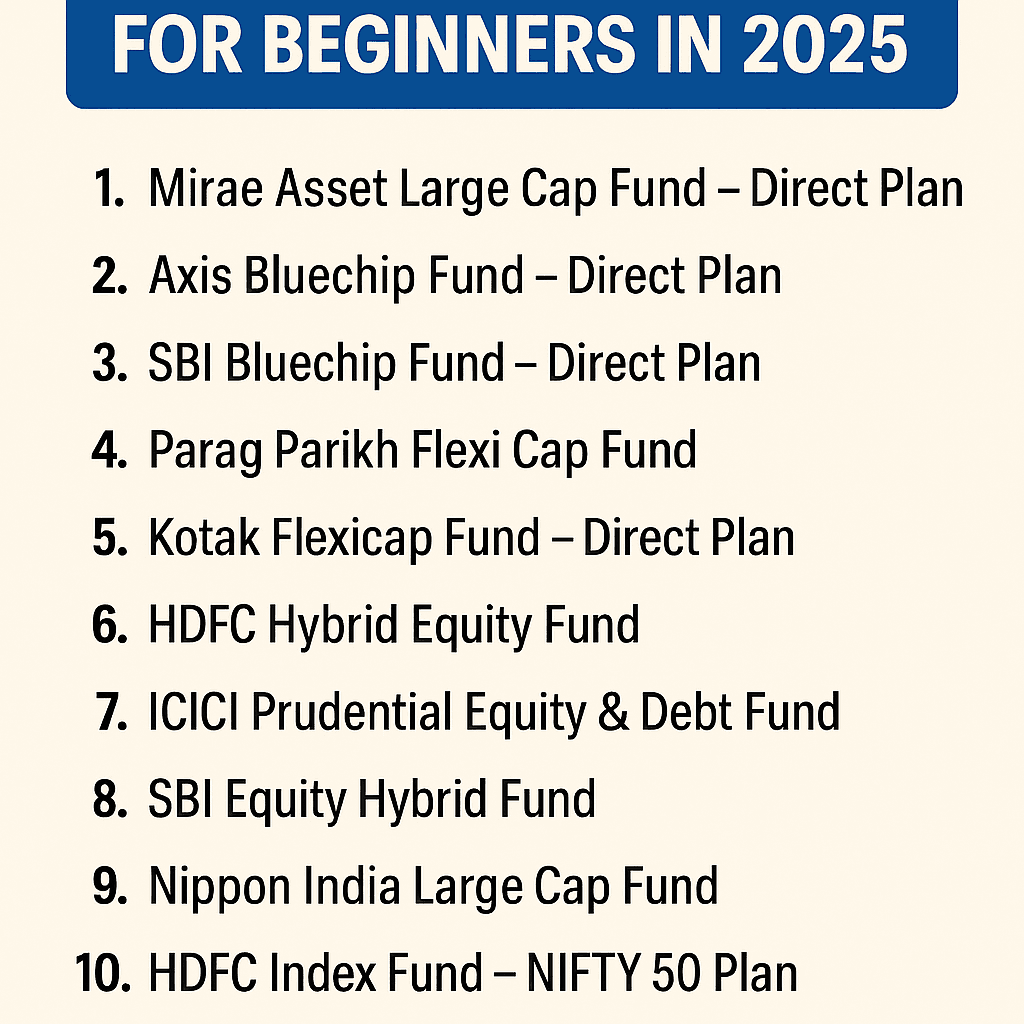

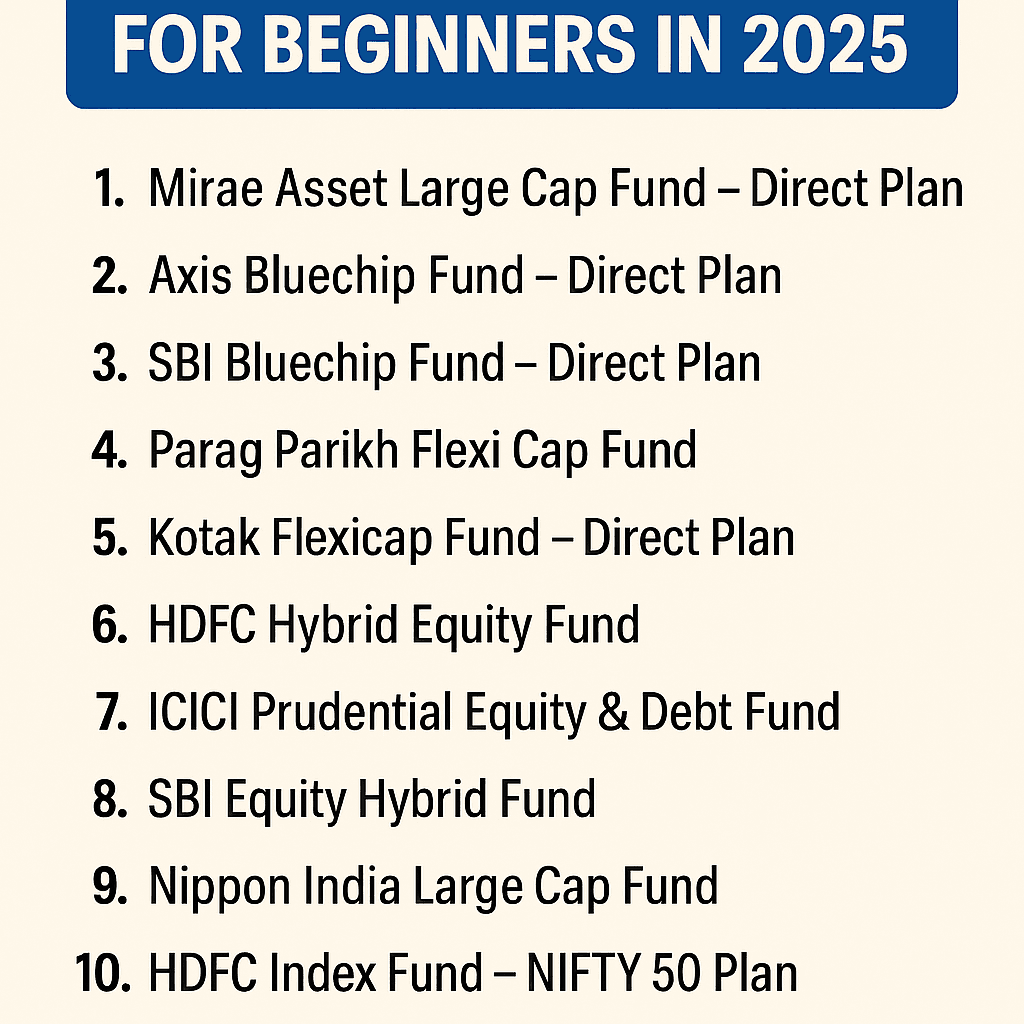

Top 10 Mutual Funds for Beginners in India (2025)

3 min read

Top 10 Mutual Funds for Beginners in India,If you are a first-time investor in India, choosing the right mutual fund can feel confusing. To make it easy, we have curated a list of the top 10 beginner-friendly mutual funds for 2025, based on long-term returns, stability, past performance, fund manager quality, and AUM strength.

Why These Funds Are Best for Beginners?

- Low to moderate risk

- Consistent long-term returns

- Suitable for SIP starting from ₹100–₹500

- Diversified portfolio

- No complicated sector bets

Top 10 Mutual Funds for Beginners (2025)

1. Mirae Asset Large Cap Fund – Direct Plan

This fund is one of the most popular in India for new investors. It invests primarily in India’s top 100 large-cap companies, offering stability and steady long-term returns.

Category: Large Cap Fund

Why good for beginners: Very stable, invests in India’s top 100 companies.

10Y Returns: ~14–15%

2. Axis Bluechip Fund – Direct Plan

A pure large-cap fund known for disciplined stock picking and controlled risk-taking.

Category: Large Cap

Why ideal: Low volatility, reliable for first-time SIP investors.

10Y Returns: ~12–13%

3. SBI Bluechip Fund – Direct Plan

This is one of SBI’s flagship funds with a huge AUM and proven track record.

Category: Large Cap

Why ideal: Trusted fund house, balanced risk profile.

10Y Returns: ~11–12%

4. Parag Parikh Flexi Cap Fund

A unique fund offering global diversification alongside Indian equities, reducing market dependency.

Category: Flexi Cap

Why ideal: Diversified globally, low downside risk.

10Y Returns: ~17–18%

5. Kotak Flexicap Fund – Direct Plan

This fund adjusts allocation between large, mid, and small caps depending on market conditions.

Category: Flexi Cap

Why ideal: Flexible across large, mid, and small caps.

10Y Returns: ~14%+

6. HDFC Hybrid Equity Fund

One of India’s most trusted hybrid funds. It invests 65–80% in equities and the rest in debt.

Category: Hybrid (Equity + Debt)

Why ideal: Safer for beginners, less volatility.

10Y Returns: ~11–12%

7. ICICI Prudential Equity & Debt Fund

An aggressive hybrid fund offering a balance of growth and stability.

Category: Aggressive Hybrid

Why ideal: Perfect mix of safety + returns.

10Y Returns: ~12–13%

8. SBI Equity Hybrid Fund

This remains a beginner favourite because of its stability and massive trust factor.

Category: Hybrid

Why ideal: One of India’s most trusted funds for first-time investors.

10Y Returns: ~11–12%

9. Nippon India Large Cap Fund

A strong large-cap option with a decade of steady, predictable performance.

Category: Large Cap

Why ideal: Stable, predictable, strong long-term track record.

10Y Returns: ~12–14%

10. HDFC Index Fund – NIFTY 50 Plan

For absolute beginners who want a “zero-expertise” fund, this index fund is perfect. It simply mirrors the Nifty 50 index.

Category: Index Fund

Why ideal: Best “no-expertise-needed” fund for beginners.

10Y Returns: Mimics Nifty 50 (around 12–13%)

“If you’re also looking to park your emergency funds, check our guide on the Best Savings Bank Accounts 2025.”

How Much Should Beginners Invest?

- Start SIP from ₹500 or ₹1,000

- Increase SIP by 10% every year (step-up)

- Stay invested for 5+ years

Beginner Tips Before Investing

- Don’t check NAV daily

- Avoid stopping SIPs during market falls

- Invest for long-term goals

- Always diversify across 2–3 funds only

- Select Direct Plans (lower expense ratio)

How Beginners Should Start Investing in Top 10 Mutual Funds for Beginners

- Start with 2–3 funds, not more

- SIP of ₹500–₹2000 is enough initially

- Increase SIP every year by 10% (step-up)

- Never stop SIPs during market falls

- Stay invested for at least 5 years, ideally 10+

Final Advice for Beginners

Top 10 Mutual Funds for Beginners in India ,Mutual funds work best when investors remain disciplined. Avoid checking returns daily, trust the process, and allow time for compounding. Beginners should focus on stability first, growth next. Once confidence builds, you can gradually explore mid-cap or sector funds.

Investing early, even with small amounts, can significantly impact future wealth—and these 10 funds offer the best starting point in 2025.